Reading the Credit Report

In this quick step guide you will learn how to read the Distributor Credit Report.

-

The Distributor Credit Report is filled with in-depth financial information to help suppliers make educated decisions when selecting business prospects and partners. For information on how to access the Distributor Credit Report, click here.

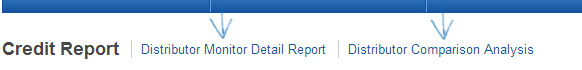

The Distributor Monitor Detail Report and Distributor Comparison Analysis are easily accessible through the blue links at the top of the report screen.

You can read in the credit report its entirety or you can navigate to the topic of your choice by clicking on the report navigation links.

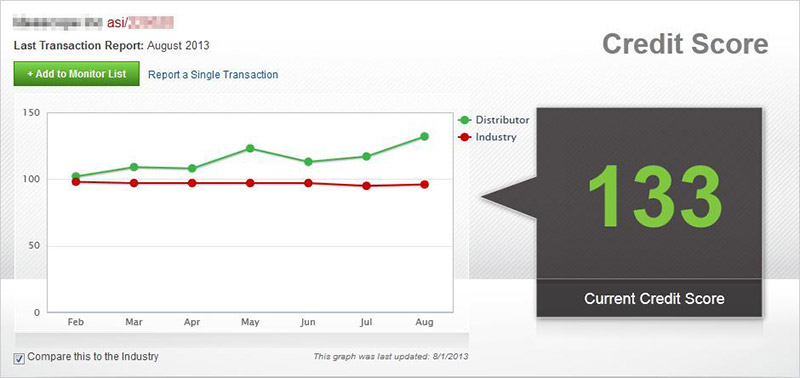

In the top section, there is the distributor’s name, ASI number and last transaction report date. You are able to add this distributor to your monitor list by clicking on the Add to Monitor List button.

You can also use the report a single transaction link to add a report for this distributor.

There is then a chart with the average industry credit score and the distributor’s credit score. The distributor’s credit score is also displayed prominently in the grey box.

Directly below the Credit Score area are the report navigation links, which enable you to immediately access that section of the distributor credit report. The available sections are:

- Profile

- Credit score

- Credit history

- Average pay habits

- Past due invoices

- References

- TOC (Turn over for collection)

- NSF checks (Non-sufficient funds checks)

- Branches

- Notes

The Distributor Profile supplies extensive contact information, including: mailing, delivery and email addresses, as well as full electronic contact information. Company revenue and employment figures are also included in the Distributor Profile. Additionally, under Company Information, you are able to see the most popular products searched by the distributor by clicking Product: View link, as well as what year the company was established, years as an ASI member and current hours of operation.

Below the Distributor Profile is the Distributor Credit Score, which provides you with real-time credit details. Scores are ranked on a numeric scale to indicate risk level. The higher the distributor’s credit score is, the lower the risk of a late or non-payment. Their bracket will be highlighted for you and you can view the key elements that contribute to the overall score.

Note: NSF is an abbreviation for Non-Sufficient Funds and DBT is an abbreviation for Days Beyond Term.

The Distributor Credit History, suppliers can compare a distributor’s paying habits to those of the rest of the industry average (shown in the green column). The average payment time, high credit extended, average high credit, number of purchases, volume of purchases (in dollars) and the average invoice amount are viewable for the current and previous 6-month period. In the red column, the number of bankruptcies, collections, write-offs, disputes and NSF checks are reported.

The Average Paying Habits lists the number of Reports with Purchases, Transactions with Purchases and dollar Volume of payments made by the distributor in numerous payment intervals up to 150+ days. Supplier Choice (when the supplier chooses to charge up-front) and Distributor Choice (when the distributor chooses to pay up-front) display first.

Past Due Invoices reveal the date an invoice was reported past due, its pay code, whether the invoice is disputed, the sales terms, the total owing and dollar amount past due at 30 day intervals up to 90+ days.

References show distributor-provided bank and supplier references. Beneath those, references from the distributor’s reporting suppliers appear along with their contact information.

Turn Over For Collection Details lists the debt invoice date, action date, amount, whether the debt was turned over, written off or disputed, the amount paid to date and the last pay date.

The NSF (Non-Sufficient Funds) Checks Detail lists the invoice date and amount of the distributor’s Non-sufficient Funds (bounced) checks.

Branch Office Information lists addresses of all branches/locations for the distributor, if applicable.

Notes can be added for any distributor a supplier has reported doing business with in the previous six months. Once you begin typing in the box, you are able to determine the level of privacy for your notes:

- Don't let anyone see this note - It's just for me: Your note will only be seen by you.

- Share this note with other users in my Company: Your note will be available to all Connect users within your company.

- Share this note with other industry suppliers: All Connect subscribers will be able to view your note.